With the movement in the Medicare market, you’re probably hearing more about Dual Eligible Special Needs Plans (D-SNPs) lately.

Whether you’re new to D-SNPs or searching for information to fine-tune your selling techniques, this quick guide will cover all the basic information you need to know about these valuable, multifaceted products.

Did you know we created an in-depth eBook on D-SNPs? Check it out!

What Are D-SNPs?

D-SNPs are a type of Medicare Advantage (MA) Special Needs Plan.

Each state determines which D-SNPs a carrier can offer and the benefits they can include. Generally speaking, D-SNPs include the following:

- Care coordination

- $0 monthly premiums

- Over-the-counter quarterly benefits

- Dental, vision, and hearing benefits

- Transportation benefits

- Gym memberships and wellness programs

- Telehealth services

There are exciting opportunities for agents selling D-SNPs in the Midwest! Learn more about the disruption here

The Different Types of D-SNPs

There are three different criteria used to categorize D-SNPs: their network, the Medicaid levels they serve, and their level of integration with Medicaid.

PPO vs. HMO D-SNPs

When categorizing D-SNPs by network, there are two categories: health maintenance organization (HMO) and preferred provider organization (PPO). Most D-SNPs are HMOs.

D-SNPs & Networks

Full vs. Partial D-SNPs

There are different types of D-SNPs based on Medicaid levels: Full-Benefit Dual Eligible (FBDE), Medicare Zero Cost Sharing, Dual Eligible Subset, and Dual Eligible Subset Medicare Zero Cost Sharing. Partial D-SNPs may accept individuals who fall into the following Medicaid categories: Medicare Zero Cost Sharing, Dual Eligible Subset, or Dual Eligible Subset Medicare Zero Cost Sharing. The type of enrollees they accept varies based on the plan.

D-SNPs & Medicaid Levels

Effective January 1, 2027, parent organizations that operate an affiliated Medicaid plan in a region may only offer one FBDE D-SNP there. They may offer additional D-SNPs for partial dual eligibles in that same area.

Integrated vs. Non-Integrated D-SNPs

Some D-SNPs coordinate with their state’s Medicaid program to different extents. Fully integrated D-SNPs (the most integrated option) are affiliated with their state’s MMCO through a single entity that holds both an MA contract with CMS and a MMCO with the applicable state.

Highly integrated D-SNPs are affiliated with their state’s MMCO through:

- The same MA organization; or

- The MA organization’s parent organization; or

- Another entity that is owned and controlled by its parent organization.

Integration facilitates aligned enrollment, where enrollees receive their Medicaid benefits through the D-SNP or affiliated MMCO. Non-integrated D-SNPs are not affiliated with their state’s MMCO.

Some D-SNPs feature exclusively aligned enrollment, only accepting enrollees who receive their Medicaid benefits through the D-SNP or their affiliated MMCO. Exclusively aligned D-SNPs may not enroll partial duals since these individuals are not enrolled in an MMCO.

There are four types of integrated D-SNPs, shown below.

D-SNPs & Medicaid Integration

As part of CMS’ 2025 Medicare Final Rule, starting in 2027, CMS will limit enrollment into certain D-SNP plans to individuals also enrolled in or in the process of enrolling in an affiliated MMCO. To further enforce care and benefit coordination, CMS is requiring that, by 2030, D-SNPs with an affiliated MMCO will have to disenroll any dually eligible individuals who are not already enrolled in the MMCO.

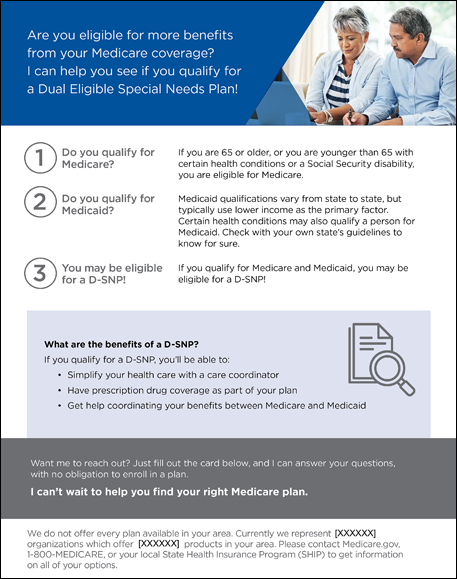

Who Qualifies for D-SNPs?

Dual-eligibles, individuals of any age who are eligible for both Medicare and Medicaid, qualify for D-SNPs.

Use Integrity’s D-SNP Client Eligibility Letter to identify clients that could be eligible for D-SNP benefits! Additionally, distribute Integrity’s doctors, providers, and prescription drugs checklist to notify clients of the benefits they could be eligible for!

To be eligible for Medicare, individuals must be 65 years old or older or have a qualifying disability. To be eligible for Medicaid, an individual’s income and asset level must fall below certain thresholds determined by their state.

The type of plan a dual-eligible can enroll in depends upon the Medicaid category they fall under (see D-SNP & Medicaid Levels table) and the plans available in their service area.

Remember, always verify a client’s Medicaid eligibility before enrolling him or her in a D-SNP. Many D-SNP carriers have agent support personnel who can assist you with this task.

Default Enrollment

An individual may be automatically enrolled into a D-SNP when they are on Medicaid and become newly eligible for Medicare and the individual is in a Medicaid MMCO affiliated with the D-SNP. Individuals must receive a notice of the upcoming enrollment at least 60 days before it will occur and have the opportunity to opt out.

When Can You Sell D-SNPs?

Similar to other MA plans, you can sell D-SNPs to someone in their Initial Coverage Election Period (ICEP), Annual Enrollment Period (AEP), or the Medicare Advantage Open Enrollment Period (MA OEP), if they qualify.

When someone becomes eligible for an integrated D-SNP, they qualify for a Special Enrollment Period (SEP) to join one. As long as they maintain their eligibility for Medicare and Medicaid, they have an SEP to elect an integrated D-SNP once during each month.

D-SNP Election Periods

*Exception: Full-benefit dually eligible individuals in Medicaid MCOs can’t select misaligned D-SNPs where applicable

Where Can You Find D-SNP Prospects?

D-SNP prospects are all around you, especially if you work near an urban or generally low-income area. If you sell near a large rural area, it will be more difficult to get prospects because CMS won’t allow D-SNPs in counties that don’t have a certain number of doctors. It will also be difficult to get clients if you do business near moderately to highly wealthy areas, since the type of prospects you’re looking for wouldn’t be able to afford living there.

Since welfare programs and Social Security disburse payments near the beginning of the month, you should be able to attract D-SNP prospects in places where dual-eligibles spend money during the first half of the month. During the second half of the month, you should be able to attract them at places where dual-eligibles seek assistance.

While you cannot scout potential clients, you can host a compliant Medicare educational or sales event or leave compliant promotional materials where D-SNP prospects might go. These actions can help you stand out as a resource in your community for D-SNP prospects to come to you.

First Half of the Month:

- Dollar stores (e.g., Dollar Tree, Dollar General, and Family Dollar)

- Discount stores (e.g., Walmart, Ollie’s Bargain Outlet, Price Rite, Big Lots, Ocean State Job Lot, etc.)

- Thrift shops and flea markets

Second Half of the Month:

- Food pantries

- Food banks

- Soup kitchens

Anytime Throughout the Month:

- Utility assistance locations

- Community events (e.g., senior expos and health fairs)

- Charity events

- Churches or other faith-based organizations

- Areas with low-income housing

- Senior centers

- Retirement communities

Looking to attract more prospects? Give these strategies for growing your insurance sales territory a try

How Can You Build Your D-SNP Business?

To build your D-SNP book of business, you’ll want to focus your efforts on two main objectives: utilizing grassroots marketing and providing superior customer service.

Utilizing Grassroots Marketing

Taking a grassroots marketing approach is the most effective way to get D-SNP leads and build your D-SNP client base.

Taking a grassroots marketing approach is the most effective way to get D-SNP leads.

Grassroots marketing involves going out into the community where prospective clients are, engaging with them, as well as forming relationships with other professionals in the community who can refer prospective clients to you. Some strategies include:

- Volunteering at food banks, food pantries, soup kitchens, and charity events

- Visiting community centers, retirement communities, and areas with low-incoming housing

- Hanging tear-off flyers or business cards on bulletin boards at indoor flea markets, thrift stores, or churches

- Forming partnerships with churches, provider offices, non-profit organizations, and retailers

- Setting up your own booth at community events

- Holding educational events and sales events

“Grassroots marketing gets you closer to your community on a deeper level and builds loyalty. Folks in the D-SNP market are many times looking for help, and if you have been on the ground with them in their community building their trust, they are more likely to work with you.” — Lincoln LaFayette, President, Quick Insured Brokerage

Note: You MUST follow all CMS Medicare Advantage & Part D Communication Requirements for marketing these plans and holding events. For more information on how to stay compliant, check out our do’s and don’ts of Medicare compliance.

Providing Superior Customer Service

Treating people right will increase your chances of converting prospects into clients, getting referrals from existing clients or professionals within your community, and retaining clients.

You can provide superior customer service by:

- Becoming well-informed on the subjects you hear prospects and clients asking questions about

- Educating your prospects and clients on their health insurance programs and options

- Making sure your clients understand their plans and benefits and how to access their care

- Letting your prospects or clients know about other people or programs that can help them with their non-health insurance related needs (when appropriate)

How Can You Retain D-SNP Clients?

The fact that dual eligibles may be able to join or switch D-SNPs mid-year can be a double-edged sword. On one hand, it gives you the opportunity to find new MA clients anytime throughout the year. On the other, it gives other agents the opportunity to simultaneously swoop in and steal your clients.

In order to avoid losing your D-SNP clients, ensure you:

- Establish trust with them. Be someone they know they can come to with health insurance questions.

- Provide them with superior customer service. Do everything you can to help them (while maintaining a professional relationship) and communicate effectively (in person and digitally).

- Confirm they’ll know how they can best reach you when they have a question. Give them your phone number and email address. Tip: Fridge magnets are harder to lose than a business card.

- Follow up with them within the first 30 and 90 days and then every six months to one year. Check how they’re doing, if their income or prescription drug needs have changed, and if they have used the extra benefits (e.g., dental, vision, over the counter).

Taking these measures can help you build client loyalty. Don’t forget, the smallest of actions can make a huge difference in the lives, and minds, of others.

Why Sell D-SNPs?

You’ve learned that selling D-SNPs can earn commissions during Medicare’s off-season, but there’s one point we need to make clear: If you’re only interested in selling these products for your own profit, you may quickly find that you’re not working in the right market.

The dual-eligible population can be difficult to work with. Out in the field, you’ll encounter many people confused by their health insurance options. Your ability to explain things in an easy-to-understand manner and effectively answer questions will be tested. You may even find yourself in houses that make you feel uncomfortable.

Simply put, agents who sell D-SNPs do so because they truly want to help others through their business. You should sell them if you want to do the same.

Contracting with D-SNPs can open the door to many new opportunities for your business. To learn more about these products or to find out which ones are most competitive near you, send us a message.

Not affiliated with or endorsed by Medicare or any government agency.

Share Post