Eventually, we all have to think about how we’ll pay for a loved one’s, or even our own, end-of-life expenses. When you sell final expense insurance, you can provide your clients with the peace of mind that comes with knowing they and their families are prepared for the future. You can also gain an opportunity to maximize your book of business and create a new income stream! Ready to learn everything you need to know to start selling final expense insurance successfully?

Understanding the Basics

Nobody likes to think about their own death, but the fact of the matter is funerals and burials aren’t cheap. Depending on the situation and one’s personal preferences, they can actually cost thousands of dollars. The National Funeral Directors Association (NFDA) reports the national median cost of a funeral with a viewing and burial is approximately $8,300. Final expense insurance can help someone ensure their last wishes regarding their end-of-life ceremony and final resting place can be carried out by the loved ones they leave behind. This average cost includes only the basic items required for a funeral and does not include a number of additional costs that need to be considered, such as a headstone or vault.

Final expense insurance can help someone ensure their last wishes regarding their end-of-life ceremony and final resting place can be carried out by the loved ones they leave behind.

What Is Final Expense Insurance?

Also known as “burial insurance” or “funeral insurance,” final expense insurance is a type of permanent whole life policy. Instead of providing income replacement for loved ones (like most life insurance policies do), final expense insurance is meant to cover the costs associated with the policyholder’s viewing, funeral, and cremation or burial. Legally, however, beneficiaries can often use the policy’s payout to pay for anything they wish.

Generally, this type of policy is issued to people ages 50 to 85, but it can be issued to younger or older individuals as well. It often has a lower face value than other whole life insurance policies — usually anywhere from $5,000 to $25,000 — but death benefits can go as high as $100,000.

What costs final expense insurance can cover:

- Medical bills

- Transfer of remains to funeral home and/or cemetery

- Preparation of the body

- Caskets or urns

- Burial plots and headstones

- Use of facilities and staff for viewing and/or funeral

- Memorial printed packages

- Other end-of-life expenses

In general, final expense insurance itself isn’t hard to learn, with low face amounts, low premiums, and simplified underwriting. Final expense appointments are generally short, and the target market and need for this product are both extensive.

The Types of Final Expense Insurance

There are four main types of final expense insurance: guaranteed issue, graded, modified, and level (preferred or standard rating). We’ll go more into detail about each of these product types, but you can gain a quick understanding of the differences between them via the table below.

The Different final expense policies

Note: Exact benefits and payout schedules may vary depending on the carrier, plan, and state.

GUARANTEED ISSUE

By and large, applications for guaranteed issue final expense policies are rather straightforward with no health-related questions. Carriers that provide these products will often limit issue ages, offer reduced face values, and modify the death benefits by offering return of premium plus a declared interest rate for the first two to three years of the policy. The premiums on these products are usually the highest that you will find. You’re guaranteed coverage — but at the highest rate.

Typically, guaranteed issue final expense policies are issued to clients with severe or multiple health issues that would prevent them from securing insurance at a standard or graded rating. These health conditions may include (but aren’t limited to) renal disease, HIV/AIDS, organ transplant, active cancer treatments, and illnesses that limit life expectancy. Many times, these prospects have difficulty with performing activities of daily living (ADLs) or are in nursing home care. In addition, clients for this type of plan could have severe legal or criminal histories.

Typically, guaranteed issue final expense policies are issued to clients with severe or multiple health issues that would prevent them from securing insurance at a standard or graded rating.

It’s important to note that different carriers offer a range of issue ages on their guaranteed issue policies — as low as age 40 or as high as age 80. Some will also offer higher face values, up to $40,000, and others will allow for better death benefit conditions by improving the interest rate with the return of premium or lessening the number of years until a full death benefit is available. There are even carriers that will offer built-in riders, such as chronic illness and accidental death riders. If you have a client that requires a guaranteed issue final expense policy, ensure you find the right fit for your client by comparing the features, benefits, and rates of each plan available to you

GRADED AND MODIFIED FINAL EXPENSE

Graded and modified final expense policies are very similar, but no two graded or modified final expense policies are the same. Some carriers will offer policies that have issue ages as low as 20 years old and up to 89 years old, with face values as high as $50,000.

Graded final expense policies usually have a two-year waiting period before the carrier pays the entire death benefit to a beneficiary. Some carriers don’t pay out a full death benefit on the graded policy until the fourth year.

If non-accidental death occurs before two years, the policy will only pay a percentage of the death benefit. For example:

- If non-accidental death happens in year one, the carrier might only pay 30 percent of the death benefit.

- If non-accidental death occurs in year two, the carrier might only pay 70 percent of the death benefit.

- For a non-accidental death in year three or later, the carrier would probably pay 100 percent of the death benefit.

Modified final expense policies, similar to graded plans, look at health conditions that would place your client in a more restrictive modified plan. These may include recent alcoholism, angina, stroke, aneurysm, or cancer. With modified policies, there’s usually a two-year waiting period before the carrier pays the entire death benefit to a beneficiary.

If non-accidental death occurs before two years, the policy will only pay a return of premium plus a declared percentage interest. For example:

- If non-accidental death happens in year one or two, the carrier will return the paid premiums, plus 10 percent interest (general average) on those premiums.

- For a non-accidental death in year three or later, the carrier would probably pay 100 percent of the death benefit.

Graded or modified policies aren’t only for older clients. Generally, you’ll find that clients who qualify for graded or modified final expense policies usually have less-than-perfect health and a specific health issue that is recent or chronic in nature that would prevent them from getting a standard or more traditional whole life policy. For instance, they may have chronic obstructive pulmonary disease (COPD), diabetes that is not well controlled or requires high levels of insulin, or have had heart attacks in the recent past. Some products have specific health issues that are viewed more favorably by a specific carrier. For example, there are carriers that will issue policies to younger adults in their 20s or 30s who could have chronic conditions like diabetes.

LEVEL-BENEFIT FINAL EXPENSE OR SIMPLIFIED ISSUE TRADITIONAL WHOLE LIFE

Normally, level-benefit traditional final expense or simplified issue whole life policies have the cheapest premiums and the largest availability of additional riders that clients can add to policies. This type of product usually brings the most flexibility in the form of issue age and face value, and in some cases, participating dividends.

While typical final expense carriers have limits on age, there are carriers that view their traditional whole life products, not only for use as final expense, but as insurance policies available for all types of age groups, including juvenile, young adults, and clients looking for protection and investment opportunities. Traditional whole life insurance products can go up to $100,000 in a simplified format and can start at age 0 (0 to 30 days old), so these products can be very versatile to meet a client’s needs.

Unlike guaranteed issue, graded, or modified final expense policies, traditional final expense policies are typically for clients who are in good or excellent health.

Unlike guaranteed issue, graded, or modified final expense policies, traditional final expense policies are typically for clients who are in good or excellent health. Depending on the insurance carrier, both a preferred rate class and standard rate class may be offered. A client in excellent health with no current prescription medications or health conditions may qualify for a preferred rate class with the lowest premiums possible. A client in good health — even with a few maintenance medications, but no significant health issues — may qualify for standard rates. Additionally, since these types of policies can be written outside of a true final expense need they may offer additional benefits, additional included and optional riders and even higher cash values. An illustration may be required to accompany a traditional whole life application.

Note: In a “participating policy” (also known as a “par” policy) the insurance company shares the excess profits (divisible surplus) with the policyholder in the form of annual dividends. Typically, these “refunds” are not taxable because they’re considered an overcharge of premium (or “reduction of basis”).

How Final Expense Insurance Works

In general, final expense insurance works similarly to other forms of life insurance. If your client applies for a policy, they may or may not be approved for one, depending on the plan they’ve applied for and any other qualifying factors for it. If your client purchases a policy, they’ll have to name at least one beneficiary. When your client passes away, their final expense policy will pay out to any living beneficiaries they’ve designated. Let’s take a quick look at how final expense premiums, underwriting, beneficiaries, and payouts function.

PREMIUMS AT A GLANCE

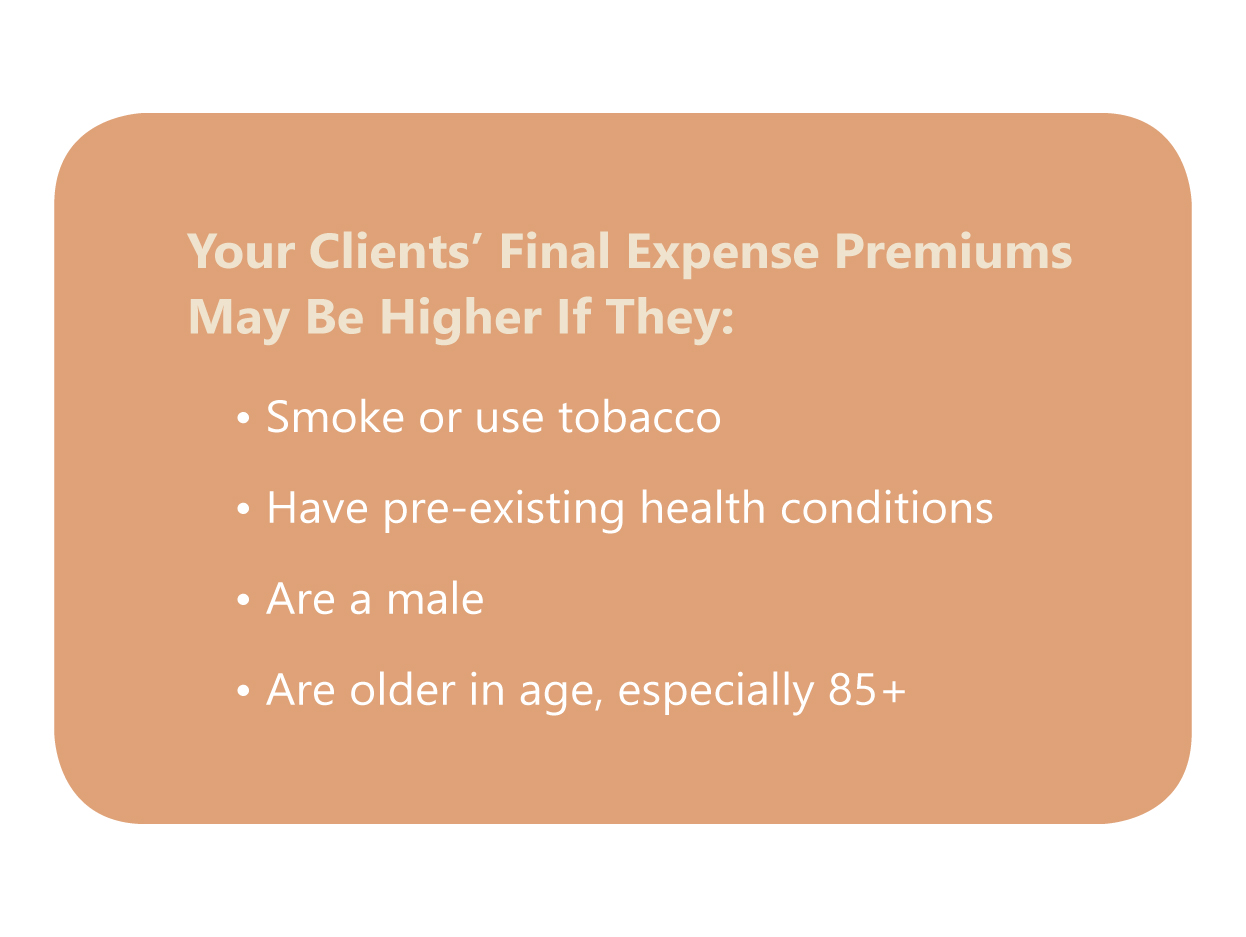

As with other insurance products, what your clients will pay for a final expense insurance policy depends on the carrier, plan, and state. Your client’s health, gender, and age can also be huge factors in determining their premium(s). Similar to other life insurance policies, if your clients smoke, use other forms of tobacco or nicotine, have pre-existing health conditions, or are male, they’ll likely have to pay a higher rate for a final expense policy. Moreover, the older your client is, the higher their rate for a plan will be, since insurance companies believe they’re taking on more risk when they offer to insure older clients.

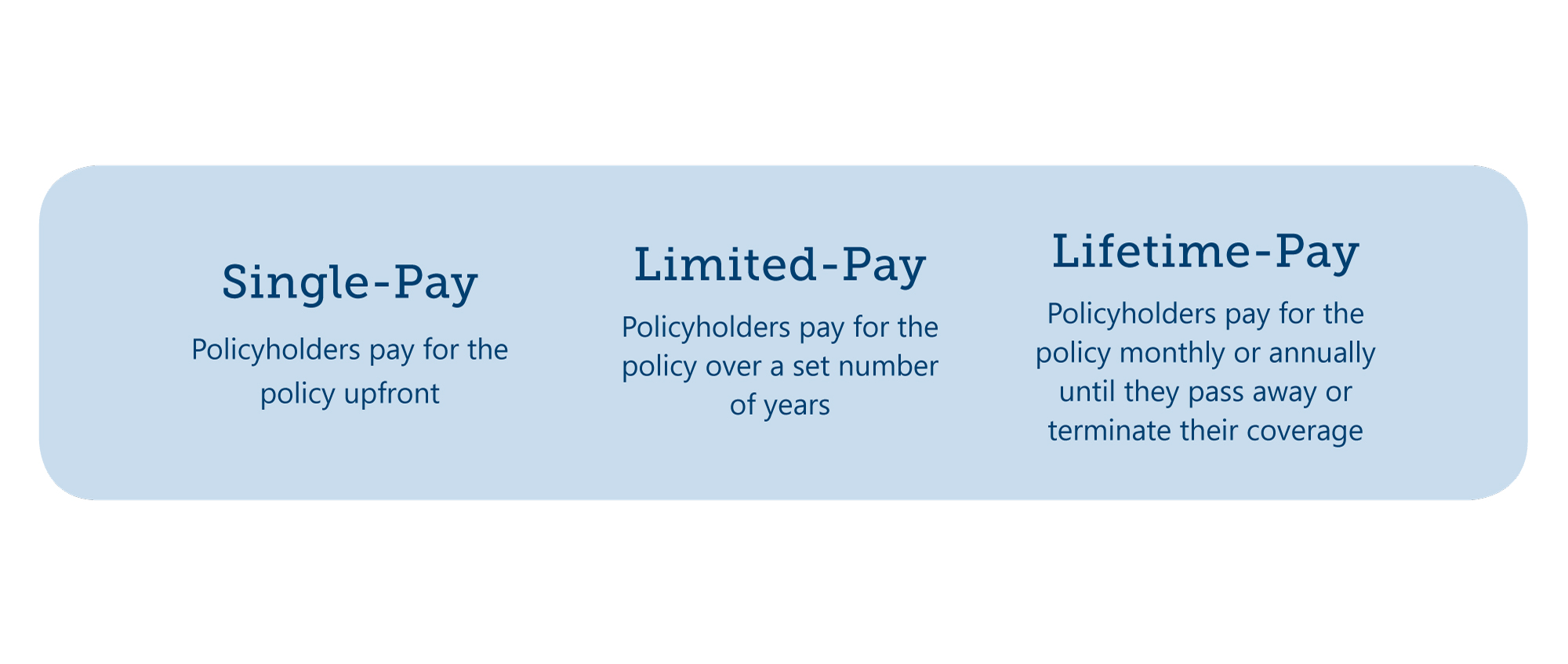

As you’re selling final expense policies, you’ll see there are three main types of premiums: single, limited, and lifetime. Single-pay policies require policyholders to pay the entire cost of the policy upfront, while limited-pay policies allow the policyholder to pay for the policy over a set number of years (usually 20 or less). With lifetime-pay policies, policyholders pay a monthly or annual premium for the policy until they pass away or decide they no longer want to continue the policy.

One nice thing about final expense insurance premiums is that, once your clients have purchased a policy, their rates will never increase. That’s because final expense policies have level (or “fixed”) premiums. The policy will also remain in force as long as the policyholder pays their premium(s).

AN INTRODUCTION TO UNDERWRITING

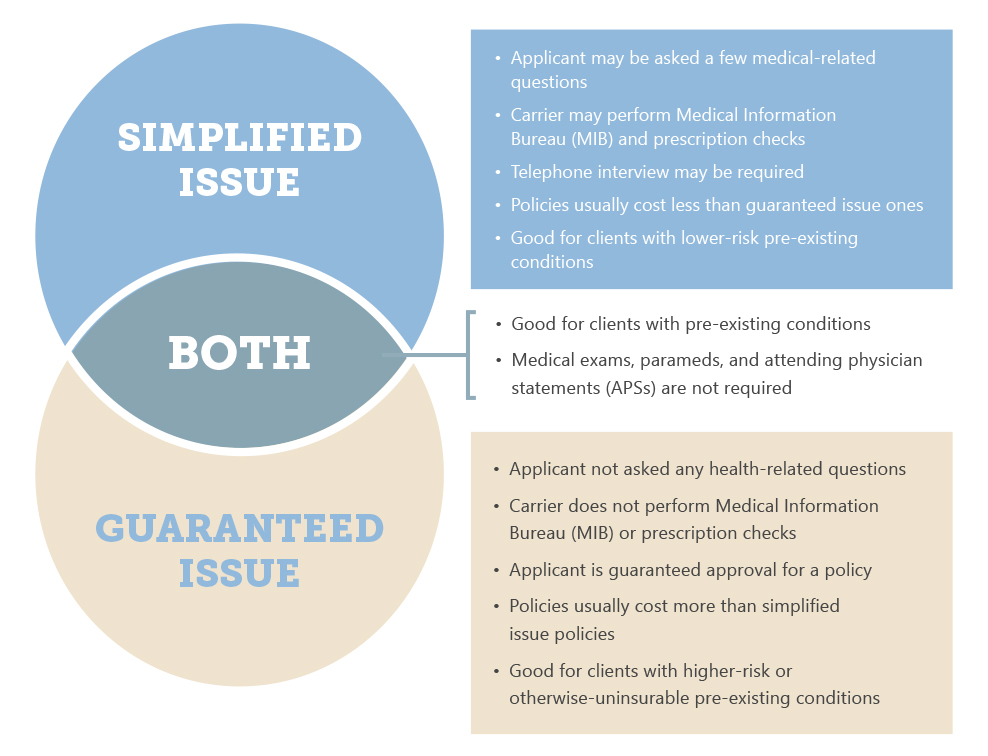

While many other life insurance policies may require medical exams, parameds, and attending physician statements (APSs), final expense insurance policies do not. That’s one of the great things about final expense policies. At most, applicants have to answer health and prescription drug questions and/or complete a telephone interview. In other words, there’s little to no underwriting required!

That being said, there are two main types of underwriting for final expense policies: simplified issue and guaranteed issue. With simplified issue policies, ciients generally only have to answer a few medical-related questions and may be denied coverage by the carrier based on those answers. Conversely, guaranteed issue policies generally don’t require the applicant to answer any medical-related questions. The applicant is guaranteed approval for a guaranteed issue final expense policy as long as they qualify for it. The diagram below outlines the differences and similarities between simplified and guaranteed issue policies.

Note: Traditional whole life pol that offer simplified issue underwriting will have more extensive underwriting than that for standard, graded, or modified final expense policies.

Even though underwriting isn’t that intense for final expense policies, it’s still important for agents to ask their final expense prospects about their health history and prescription medications. For one, this can allow agents to figure out what type of plan underwriting would work best for a particular client. And two, it helps agents narrow down their client’s options. Some carriers may disqualify clients for coverage based on what medications they’re taking and how long or why they’ve been taking them (i.e., maintenance or treatment). Other carriers disqualify clients or charge them higher rates if they have or had diabetes, chronic obstructive pulmonary disease (COPD), cancer, or heart attack(s). The number of years that carriers look back on applicants’ medical histories for certain conditions varies, but it’s often two to five years.

— END OF PREVIEW —

Learn More About the Art of Selling Final Expense Insurance in Our Free eBook!

The Complete Guide on How to Sell Final Expense Insurance makes selling final expense insurance easy for beginners and pros looking to earn more in commission! Inside, you’ll find info on the types of policies available, acquiring final expense leads, getting licensed to sell final expense, how to contract with carriers, selling final expense insurance over the phone, quoting plans, enrolling clients, and much more!

At Ritter Insurance Marketing, our primary goal is to help agents grow their businesses quickly, efficiently, and compliantly. We’re committed to being your top source for information on selling health insurance and ancillary plans, whether you already work with our company or not! We’ve been specializing in the senior health and life insurance markets for more than 20 years, and our company leaders have even more first-hand experience selling out in the field. With this guide, we seek to give all insurance agents access to free comprehensive training, that includes a ton of helpful, accurate information relevant to today’s market.

Take a Look Inside this Book!

We sincerely hope this guide helps you easily understand the ins and outs of this product and accomplish your business goals! Fill out the form to get your free download today.

Results may vary based on individual user and are not guaranteed.